AI for Revenue Forecasting: How Agentic Analytics Is Redefining Enterprise Predictability in 2026?

Companies using traditional forecasting methods achieve only 54% accuracy, meaning nearly half of their revenue predictions miss the mark. This isn't just embarrassing. It's costing businesses an estimated $2.3 million annually in poor forecasting decisions. And in a world where market conditions shift overnight, that number is climbing.

Here's the uncomfortable truth: your dashboards are lying to you. Not intentionally, but by design. They're built to show what happened, not why it happened or what's coming next. And if you're still relying on static BI tools to predict your revenue, you're essentially driving forward while staring in the rearview mirror.

The game has changed. Traditional forecasting leaves 80 to 90% of enterprise data untouched because it's unstructured. Customer complaints, market sentiment, competitive moves, and support tickets never make it into your forecasts. You're making million-dollar decisions with incomplete information.

This is where AI for revenue forecasting enters the picture. But here's the catch: slapping a GPT-style chatbot onto your existing BI tool isn't the answer. That's like putting a Tesla badge on a horse and calling it innovation. What enterprises need is agentic analytics, AI systems that don't just answer questions but actively explore data, diagnose patterns, and trigger actions.

What Does AI for Revenue Forecasting Actually Mean in 2025?

Let's clear something up right away. Most "AI-powered" forecasting tools today are just traditional BI with a natural language wrapper. They let you type questions instead of clicking buttons. That's it.

The problem runs deeper than the interface. When you plug basic large language models into enterprise analytics, you get three critical failures:

First, LLMs struggle with real enterprise data schemas. Your business doesn't run on clean, simple datasets. You've got complex multi-table joins, historical data transformations, and business logic that's evolved over years. Standard LLMs break when faced with this complexity. They generate SQL queries that look right but calculate metrics incorrectly. They miss critical joins. They ignore data governance rules.

Second, these tools can't handle follow-up exploration. You ask "Why did revenue drop last quarter?" and you get an answer. But that answer raises five more questions. Traditional GenAI gives you static, one-off responses. There's no continuous reasoning, no ability to dig deeper, no capacity to chain multiple analytical steps together.

Third, and this is the killer: they can't act on insights. Discovering that a customer segment is at churn risk means nothing if you can't automatically trigger retention workflows, alert the right teams, or adjust pricing strategies in real time.

The real shift happening in 2025 isn't about better predictions. It's about AI that reasons through complex, multi-step analysis using ALL your data, structured and unstructured, internal and external.

How Did We Get Here? The Evolution from Dashboards to Agentic Analytics

Understanding where revenue forecasting is headed means understanding where it's been. The analytics market has gone through three distinct eras, and we're right in the middle of the third revolution.

The Dashboard Era (2000s to 2020s)

Traditional BI ruled the world. Tableau, Power BI, and similar tools let you slice and dice historical data into pretty visualizations. These systems were great for answering "what happened?" They excelled at static reporting and giving executives their weekly scorecards.

But they were terrible at forecasting. Why? Because they only worked with structured data from databases. Customer sentiment from support tickets? Ignored. Market signals from news sources? Not included. Competitive pricing changes? Better hope someone manually added that to a spreadsheet.

The forecast was only as good as your structured sales data, which meant you were missing most of the story.

The Conversational Analytics Era (2022 to 2024)

Then GenAI exploded onto the scene. Vendors rushed to add natural language querying and narrative generation to their platforms. Instead of learning complex filter syntax, you could just ask "Show me Q3 sales by region." The AI would write the query, generate the chart, and even create a summary paragraph.

User experience improved dramatically. But the fundamental limitations remained. These tools were still reactive. They still waited for you to ask the right question. They still couldn't connect disparate data sources. They still couldn't explain why something happened or predict what would happen next.

Most importantly, they couldn't take action. You'd get an insight, screenshot it, send it in an email, wait for someone to read it, hope they understood it, and then maybe, eventually, someone would do something about it.

The Agentic Analytics Era (2025 and Beyond)

Agentic analytics is a key evolution, defining it as AI agents that orchestrate tasks semi-autonomously or autonomously toward stated goals across the data-to-insight workflow.

This isn't just better analytics. It's a completely different paradigm. Agentic AI systems autonomously explore data, diagnose patterns, test hypotheses, and most importantly, take actions without waiting for human intervention.

Think of it this way: a dashboard shows you that revenue dropped. Conversational analytics might tell you it's because of reduced orders in the Northeast region. Agentic analytics automatically explores supply chain delays, analyzes negative press coverage, cross-references competitor pricing changes, identifies the root cause, and triggers corrective workflows before you even ask the question.

Gartner predicts that 33% of enterprise software applications will include agentic AI by 2028, up from less than 1% in 2024. This is the foundation for AI-driven revenue forecasting that is proactive, contextual, and actionable.

Why Are Traditional Forecasting Tools Failing Enterprises?

Let me show you the five gaps that are destroying forecasting accuracy in most organizations right now.

Gap 1: Structured Data Tunnel Vision

Traditional forecasting tools only see structured data. Your CRM, ERP, and sales databases. That's maybe 10 to 20% of the information that actually drives revenue outcomes.

What about the other 80 to 90%? Customer sentiment in support tickets, negative reviews piling up online, employees flagging delivery issues in Slack, and market analysts publishing bearish reports on your industry. All of this impacts revenue. None of it makes it into traditional forecasts.

Gap 2: No Root Cause Analysis

Your dashboard shows revenue fell 15% in Q3. Great. Now what?

Traditional tools can't tell you if that drop was caused by supply chain delays, negative press coverage, a competitor's new pricing strategy, increased customer service complaints, or some combination of all four. They show correlation without causation.

Revenue forecasting without root cause analysis is just guessing with extra steps.

Gap 3: The Last-Mile Problem

This is the gap that costs the most money. You discover an insight. Someone needs to interpret it, validate it, socialize it with stakeholders, get approval, and finally act on it. This process takes days or weeks.

By the time action happens, the market has moved. The opportunity is gone. The risk has materialized.

Traditional analytics creates what I call "insight shelf life" problems. The insight expires before you can use it.

Gap 4: Trust and Transparency Issues

LLMs hallucinate. They make up metrics. They misunderstand schemas. And when they get it wrong, they do it confidently.

Enterprises can't replace analyst-driven forecasting with AI-driven forecasting unless they trust the AI. That requires audit trails, data lineage, explainable reasoning, and validation mechanisms that basic GenAI tools simply don't provide.

Gap 5: No Multi-Step Reasoning

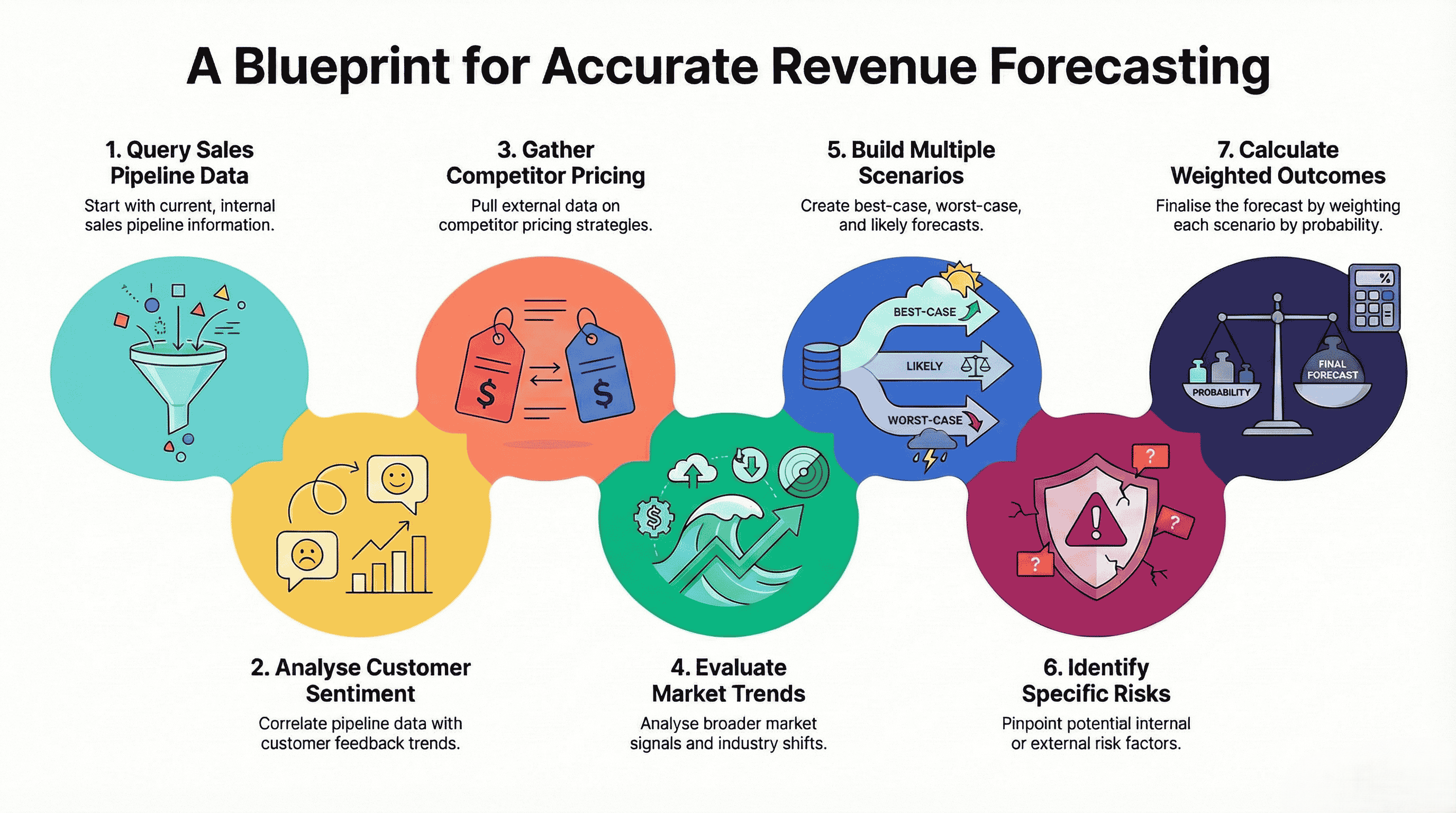

Accurate revenue forecasting isn't a single calculation. It's a chain of analytical steps:

- Query current sales pipeline data

- Correlate with customer feedback sentiment

- Pull external competitor pricing data

- Analyze market trend signals

- Build multiple scenario forecasts

- Identify specific risk factors

- Calculate probability-weighted outcomes

Traditional tools can't chain these steps together. You need a human analyst to orchestrate the process, manually moving between tools, and copying data.

That's slow, expensive, and error-prone.

How Does Agentic Analytics Actually Fix Revenue Forecasting?

Agentic AI fundamentally changes what's possible in revenue forecasting. Instead of being a passive tool that waits for questions, it becomes an active participant in your revenue operations.

Here's what makes agentic analytics different.

1. Autonomous Multi-Step Reasoning

Agentic systems break complex forecasting tasks into subtasks and execute them autonomously. You ask, "What's our revenue forecast for next quarter?" and the system:

- Analyzes current pipeline velocity

- Pulls historical win rate data

- Checks customer health scores

- Reviews support ticket sentiment

- Monitors competitor activity

- Assesses market conditions

- Builds scenario models

- Identifies risk factors

- Generates probability-weighted forecasts

- Explains its reasoning with citations

All of this happens automatically, in minutes, not days.

2. Pattern Detection and Hypothesis Testing

Agentic systems don't wait for you to notice problems. They continuously monitor data streams, detect anomalies, and investigate potential issues proactively.

If customer sentiment is declining in a specific segment, the system notices. It automatically explores whether this correlates with recent product changes, support response times, pricing adjustments, or competitive moves. It tests hypotheses, validates findings, and surfaces insights you weren't looking for.

3. Proactive Insight Surfacing

This is the killer feature. Instead of building dashboards you have to check daily, agentic systems come to you when something matters.

"Revenue forecast risk detected in Enterprise segment. Renewal rates are down 18% correlating with 25% increase in P1 support tickets. Competitor X launched aggressive pricing in this segment three weeks ago. Recommended action: Priority customer health check for top 20 accounts."

You didn't ask for this. The system figured it out and brought it to your attention.

4. Action Triggering and Workflow Integration

The best forecasting in the world is worthless if insights don't become actions. Agentic analytics doesn't stop at insights. It triggers workflows.

Detected churn risk? Automatically create high-priority tasks for account managers. Market shift affecting demand? Update inventory forecasts and notify procurement. Competitor price drop? Alert the pricing team and generate scenario analysis.

This is what moves from predictive to prescriptive to autonomous decision-making.

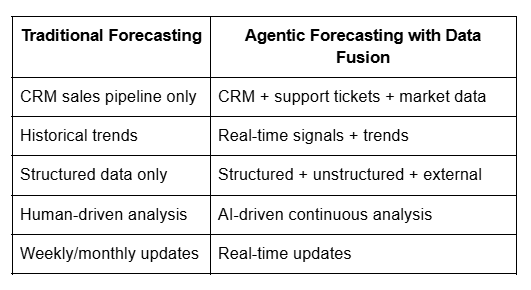

What Makes Data Fusion the Secret Ingredient?

Here's what most enterprises get wrong about AI for revenue forecasting: they think better algorithms are the answer. They're not. Better data is the answer.

Specifically, fusing multiple data types together. Modern agentic platforms don't just analyze your CRM. They combine:

1. Structured data sources:

- ERP and financial systems

- CRM and sales databases

- POS and transaction data

- Supply chain systems

2. Unstructured data sources:

- Customer emails and support tickets

- Meeting transcripts and call recordings

- Product reviews and social media

- Internal documents and reports

3. External data sources:

- Market news and analyst reports

- Competitor pricing and product launches

- Economic indicators and industry trends

- Web data and search trends

The magic happens when you fuse these together. A revenue forecast that only looks at CRM data might predict strong Q4 numbers. But when you layer in negative customer sentiment from support tickets, declining social media buzz, and a competitor's aggressive new pricing strategy, the picture changes completely.

This is why the finance team achieves single-digit forecast errors after fusing product usage, ERP, and CRM data. Data fusion eliminates blind spots.

Core Business Systems Integration: The Backbone of Agentic Forecasting

Seamless integration with core business systems is the foundation of accurate, AI-powered revenue forecasting. When forecasting tools are directly connected to your CRM, ERP, billing, and other operational platforms, you eliminate the need for manual data entry and manual data consolidation—two of the biggest sources of error and inefficiency in traditional forecasting. This integration ensures that finance teams have access to unified, real-time data flows, combining historical data with up-to-the-minute sales data and market trends.

By leveraging high-quality, consistent data from across your core business systems, AI forecasting tools can identify patterns and trends that would otherwise go unnoticed. This comprehensive data foundation enables more accurate predictions about future revenue and future sales, empowering finance teams to make smarter, data-driven decisions. Sales teams benefit as well, shifting their focus from tedious data wrangling to strategic analysis and customer engagement.

The result? Accurate revenue forecasts that reflect the true state of your business, informed by both historical patterns and current market conditions. With AI-powered forecasting tools analyzing large, integrated datasets, companies can spot opportunities and risks earlier, allocate resources more effectively, and drive better business outcomes. In short, integrating your core business systems isn’t just a technical upgrade—it’s a strategic imperative for any organization aiming to lead in the era of agentic analytics.

How Does the Agentic Workflow Engine Actually Work?

Understanding the mechanics of agentic analytics helps you evaluate vendors and implement effectively. Modern agentic platforms use a multi-agent architecture with specialized roles.

1. Knowledge Agents

These agents retrieve and synthesize information from diverse sources. They know how to read PDFs, parse emails, search logs, and pull web articles. When your forecasting system needs to understand how a recent product recall might impact revenue, knowledge agents go find and summarize the relevant information.

They're not just doing keyword search. They understand context, extract key information, and present it in a structured way that analytical agents can use.

2. Analytical Agents

These agents perform the actual analysis. They're specialized for different tasks: trend analysis, anomaly detection, statistical forecasting, root cause attribution. When you need to understand why revenue dropped, analytical agents examine patterns, test correlations, and build explanatory models.

The key difference from traditional analytics? These agents work autonomously. They decide what analysis to run, execute it, evaluate results, and iterate without human intervention.

3. The Orchestrator Agent

This is the conductor of the orchestra. When you ask a complex forecasting question, the orchestrator breaks it down into subtasks, assigns them to appropriate specialized agents, manages dependencies, and synthesizes results.

For example, "forecast next quarter's revenue accounting for market conditions" becomes:

- Task to analytical agent: calculate baseline forecast from pipeline data

- Task to knowledge agent: find relevant market news and competitor actions

- Task to analytical agent: assess sentiment from customer interactions

- Task to analytical agent: build scenario models incorporating external factors

- Synthesis task: combine analyses into a comprehensive forecast with risk factors

The orchestrator ensures all pieces come together coherently.

4. The Action Layer

Once insights are generated, specialized agents execute decisions. They can trigger alerts, update workflows, schedule meetings, adjust systems, or flag items for human review. This is how forecasting becomes operational instead of just informational.

Anomaly Detection and Response: Spotting the Unexpected Before It Hits Revenue

In today’s volatile markets, the ability to detect and respond to anomalies is essential for maintaining forecast accuracy and predictable revenue. AI-powered forecasting tools excel at anomaly detection by continuously analyzing sales data, financial systems, and market conditions for deviations from established historical patterns. When an unexpected change occurs—whether it’s a sudden dip in sales, a shift in market trends, or an irregularity in financial data—the system flags it in real time.

This proactive approach allows finance teams to investigate anomalies before they impact revenue projections or disrupt business operations. By leveraging predictive analytics and scenario modeling, companies can simulate the potential outcomes of detected anomalies and develop targeted response strategies. Integrating anomaly detection with core business systems ensures that no critical signal is missed, and that corrective actions can be triggered automatically or escalated to the right stakeholders.

Ultimately, robust anomaly detection capabilities transform revenue forecasting from a reactive process into a dynamic, forward-looking discipline. Companies can maintain high forecast accuracy, adapt quickly to changing market conditions, and safeguard future revenue by addressing issues before they escalate. In the world of agentic analytics, anomaly detection isn’t just a feature—it’s a competitive advantage.

What Do Real Enterprise Use Cases Actually Look Like?

Theory is great, but let's get practical. Here are four concrete ways enterprises are using agentic analytics for revenue forecasting right now.

Use Case 1: Predicting Renewal Revenue Using Sentiment Analysis

A B2B SaaS company with $500M ARR was struggling with renewal forecasting. Their CRM showed strong health scores, but actual renewals kept missing projections.

They implemented an agentic analytics platform that automatically analyzed support ticket sentiment alongside CRM data. The AI discovered that accounts with declining ticket sentiment (not volume, but emotional tone) were 3.2× more likely to churn, even with "green" health scores in the CRM.

The system now automatically flags accounts showing sentiment decline, triggering proactive customer success outreach. Renewal forecast accuracy improved from 73% to 91% in six months.

Use Case 2: Identifying Forecast Risks from External Market Events

A manufacturing company was consistently blindsided by market events affecting demand. By the time they manually noticed news about supply chain issues or regulatory changes, it was too late to adjust forecasts or operations.

Their agentic system now monitors news feeds, analyst reports, and competitor announcements in real time. When relevant events occur (like new tariffs or competitor plant expansions), the AI automatically models the revenue impact and updates forecasts.

Last quarter, the system detected early signals of a competitor's production issues three weeks before it became public news. They adjusted capacity planning and sales forecasts immediately, gaining market share while others scrambled.

Use Case 3: Automated Churn Prevention Workflows

A subscription business implemented agentic analytics that monitors customer engagement metrics, payment patterns, and support interactions simultaneously. When the AI detects churn risk (specific patterns like declining usage + recent billing questions + competitor mentions in support tickets), it doesn't just alert someone.

It automatically triggers a retention workflow: creates a high-priority task for the account manager, generates personalized retention offer based on customer profile, schedules executive review if account value exceeds threshold, and monitors response to adjust approach.

Customer lifetime value increased 22% and churn forecast accuracy improved from 68% to 88%.

Use Case 4: Multi-Modal Demand Forecasting

A consumer products company was forecasting demand using historical sales data and seasonality. They were consistently surprised by viral social media trends affecting product popularity.

After implementing agentic analytics with multi-modal data fusion, their system now combines structured sales data with social media sentiment, influencer mentions, search trends, and competitor product launches. The AI detected a rising trend in their product category on TikTok two weeks before it hit mainstream, allowing them to increase inventory ahead of a demand spike.

Traditional forecasting would have missed this entirely. Multi-modal agentic forecasting captured a 35% revenue opportunity that would have been lost to stockouts.

Best Practices for AI Forecasting in the Enterprise

To unlock the full potential of AI forecasting, enterprises must adopt a set of best practices that ensure both accuracy and long-term value. First and foremost, prioritize data quality. High-quality, complete, and consistent data is the lifeblood of accurate forecasts. Automating data collection and eliminating manual data entry reduces errors and ensures that forecasting tools are working with the best possible information.

Next, select AI forecasting tools that integrate seamlessly with your existing systems—CRM, ERP, and financial platforms. This integration enables real-time data access and supports finance teams in making timely, data-driven decisions. Training and upskilling your finance teams is equally important; they need to understand how to interpret AI-generated insights and leverage forecasting capabilities for strategic planning.

Continuous monitoring and evaluation are also critical. Regularly review forecast accuracy, assess the performance of your AI forecasting tools, and make adjustments as needed to maintain quality data and reliable predictions. By following these best practices, organizations can move beyond static forecasts and manual processes, embracing a future where AI forecasting drives smarter business decisions and sustained growth.

Why Does Trust Matter More Than Accuracy?

Here's a truth that makes executives uncomfortable: you can have a perfectly accurate forecasting model that never gets used because no one trusts it.

Traditional analysts had one advantage over early AI systems: you could interrogate them. "How did you calculate this?" "What assumptions did you make?" "Which data sources did you use?" They could explain their reasoning, show their work, and build trust through transparency.

Black box AI systems break this trust model. When an LLM generates a forecast, can you audit the logic? Can you verify the data sources? Can you trace how it handled edge cases? Usually not.

This is why governance, transparency, and validation are non-negotiable for enterprise-grade agentic forecasting. Modern platforms must include:

- Role-Based Access Control: Not everyone should see all data or all forecasts. Security and compliance require granular permissions that respect organizational hierarchies and data sensitivity.

- Complete Audit Trails: Every forecast, every insight, every action taken by the AI must be logged. Who asked what question? What data was accessed? What reasoning was applied? What actions were triggered? All of this needs to be traceable and reviewable.

- Data Lineage and Provenance: Where did each piece of information come from? When was it collected? How was it transformed? Which systems were queried? Data lineage isn't just a nice-to-have, it's essential for debugging when forecasts go wrong and for regulatory compliance.

- Semantic Layer Grounding: The AI needs to understand your business definitions. What exactly counts as "revenue" in your organization? How do you calculate "customer lifetime value"? A semantic layer ensures the AI uses business terms consistently and correctly.

- Retrieval-Augmented Generation with Citations: When the AI makes a claim, it should cite its sources. Not vague attribution like "according to recent data" but specific citations like "based on Q3 sales data from Salesforce, extracted October 15, 2025, table opportunity_history." This makes insights verifiable and trustworthy.

Without these trust mechanisms, you can't replace manual analyst-driven forecasting with AI-driven forecasting. The governance foundation must be rock solid before you can scale agentic analytics across your organization.

What ROI Can You Actually Expect from Agentic Forecasting?

Let's talk numbers. What changes when you move from traditional to agentic forecasting?

The impact shows up in five key areas:

- Faster Risk Detection: Traditional forecasting might identify a revenue risk at the end of the quarter during the monthly review. Agentic systems detect it in real time, often weeks earlier. The ability to respond to problems before they fully materialize is worth millions in preserved revenue.

- More Accurate Planning: Companies using AI achieve forecasting accuracy of 85 to 97% versus 65 to 75% with traditional methods. That 20+ percentage point improvement translates directly to better resource allocation, more efficient inventory management, and reduced waste from over or under-investment.

- Shortened Data-to-Action Cycle: The time from "something changed" to "we responded" drops from days or weeks to hours or minutes. In fast-moving markets, this speed advantage compounds. Early movers capture opportunities that late movers never see.

- Improved Renewal and Expansion Predictions: By incorporating sentiment analysis, behavioral signals, and external factors, agentic systems predict customer outcomes more accurately. This enables proactive intervention instead of reactive damage control.

- Autonomous Response to Market Changes: The biggest ROI comes from eliminating human bottlenecks. When market conditions shift, agentic systems adjust forecasts, alert stakeholders, and trigger responses automatically. You're not waiting for someone to notice, analyze, socialize, and act.

One concrete example: SEGA achieved 10× faster insights after implementing AI-powered analytics. That's not 10% faster. That's an order of magnitude improvement in time-to-insight.

The financial impact varies by industry and implementation, but companies report average revenue increases of 23% after implementing AI-powered revenue intelligence platforms with agentic capabilities.

Monitoring and Evaluating AI Forecasting Performance

Ensuring the ongoing effectiveness of AI forecasting requires rigorous monitoring and evaluation. Start by establishing clear metrics for forecast accuracy, such as mean absolute error (MAE) or mean absolute percentage error (MAPE), and benchmark your performance over time. Regular analysis of these metrics helps finance teams pinpoint areas for improvement and refine forecasting models to better reflect evolving market trends and sales processes.

Leverage data visualization tools to provide real-time insights into forecast performance, enabling rapid response to shifts in sales data, market conditions, or financial systems. This continuous feedback loop supports strategic planning and helps maintain predictable revenue, even as business environments change.

A deep understanding of the underlying data is essential—knowing where your data comes from, how it’s processed, and how it reflects actual business activity. By identifying trends and patterns within your data, you can anticipate changes in future revenue and make smarter business decisions. Ultimately, robust monitoring and evaluation of AI forecasting capabilities ensure that your organization stays ahead of the curve, maximizing the value of your investment in agentic analytics.

Where Does Revenue Forecasting Go from Here?

We're at an inflection point. The shift from dashboards to conversational analytics was about better interfaces. The shift to agentic analytics is about fundamentally different capabilities.

Dashboards are dead for forecasting. They're still useful for monitoring and reporting, but they can't predict the future in volatile markets with incomplete data.

Conversational analytics was a transitional phase. Natural language querying improved accessibility, but it didn't solve the core problems of forecasting: data blind spots, reactive approaches, and inability to act on insights.

Agentic analytics is the definitive model for enterprise revenue forecasting going forward. It's not just incrementally better. It's categorically different.

The platforms that win in this era will be those that master four capabilities:

- Multi-Modal Data Fusion Seamlessly combining structured, unstructured, and external data sources without requiring manual integration work.

- Multi-Agent Reasoning Orchestrating specialized AI agents that autonomously explore, analyze, and act on data without human intervention for routine cases.

- Robust Governance Providing the transparency, auditability, and control that enterprises require to trust AI-driven decisions.

- Autonomous Action Moving beyond generating insights to automatically triggering workflows, updating systems, and executing decisions.

Success requires choosing platforms built specifically for this era. Systems designed from the ground up for agentic workflows, not legacy BI tools with AI features bolted on.

AI for revenue forecasting only works when it's grounded in real agentic capabilities: multi-modal data fusion, autonomous multi-agent reasoning, enterprise-grade governance, and the ability to act on insights automatically.

The question isn't whether to adopt agentic analytics. It's whether you'll adopt it before your competitors do.

FAQs

1. How is AI for revenue forecasting different from traditional predictive analytics?

Traditional predictive analytics uses historical data and statistical models to project trends forward. It's limited to structured data, requires manual setup, and produces static predictions that need human interpretation. AI for revenue forecasting, particularly with agentic analytics, autonomously explores multiple data sources (structured and unstructured), continuously updates predictions as new information arrives, explains its reasoning, and can trigger actions based on insights. The accuracy difference is significant: traditional methods achieve 65 to 75% accuracy while modern AI approaches reach 85 to 97%.

2. What are AI agents, and how do they improve revenue forecasting?

AI agents are autonomous software systems that can perceive their environment, make decisions, and take actions to achieve specific goals. In revenue forecasting, different specialized agents work together: knowledge agents retrieve information from documents and external sources, analytical agents perform statistical analysis and pattern detection, orchestrator agents coordinate complex multi-step tasks, and action agents trigger workflows based on insights. This multi-agent approach handles complex forecasting scenarios that would require multiple tools and manual coordination in traditional systems.

3. Does agentic AI require replacing our existing BI and analytics stack?

Not necessarily. Modern agentic analytics platforms are designed to work alongside existing systems, not replace them. They integrate with your CRM, ERP, data warehouse, and BI tools, augmenting them with autonomous reasoning and action capabilities. The key is choosing platforms built for integration rather than systems that require ripping out your current infrastructure. However, you should evaluate whether your current vendors are adding genuine agentic capabilities or just doing "agent-washing" by rebranding existing features.

4. How long does it take to see ROI from agentic revenue forecasting?

Implementation timelines vary, but most organizations see initial results within 3 to 6 months. Early wins typically come from improved forecast accuracy and faster insight generation. The full ROI, including improved renewal rates, better resource allocation, and autonomous response capabilities, typically materializes within 9 to 12 months. However, success depends heavily on data readiness, organizational change management, and whether you're implementing true agentic capabilities versus basic GenAI features.

5. What are the main risks and challenges with implementing agentic AI for forecasting?

The main challenges include: ensuring data quality across multiple sources before implementation, establishing proper governance frameworks for AI-driven decisions, managing the organizational change required to trust AI-generated forecasts, avoiding "agent-washing" vendors who rebrand existing tools without true agentic capabilities, and balancing autonomy with human oversight for high-stakes decisions. Success requires cutting through hype to focus on platforms with proven track records, strong governance features, and genuine multi-agent architectures.

Transform Your Business With Agentic Automation

Agentic automation is the rising star posied to overtake RPA and bring about a new wave of intelligent automation. Explore the core concepts of agentic automation, how it works, real-life examples and strategies for a successful implementation in this ebook.

More insights

Discover the latest trends, best practices, and expert opinions that can reshape your perspective

Contact us