AI Agents in Finance for Risk Assessment | 2025 Guide

Handling financial risks is a big challenge. Old ways of checking credit or spotting problems take too long and often miss details. AI agents in finance are stepping in to handle this faster and with fewer mistakes.

Risk managers at mid-size banks waste 32 hours weekly on manual credit assessments that AI agents in finance complete in 4 hours. With regulatory fines hitting $10.4B in 2023 and customers expecting same-day loan decisions, manual risk processes are now a competitive liability.

AmpCome's AI agents have helped 47 financial institutions cut risk assessment time by 85% while improving accuracy from 77% to 96%.

The $2.8 Trillion Risk Assessment Problem in Financial Services

Banks and lenders deal with huge amounts of money and data every day. AI for financial risk management means letting smart software watch these numbers and flag trouble early. This way, problems get spotted before they grow.

Financial institutions handle trillions every day, but a hidden threat lurks behind the numbers. With nearly $2.8 trillion at stake, one bad model or wrong prediction can trigger massive losses. The problem is about trust and making faster decisions.

How Agentic AI in Banking Works Together

AI agents in finance are like having a team of smart helpers. Each AI agent focuses on a part of the risk process. They work together, sharing information to get the full picture. This teamwork speeds up how risk is checked and makes it more accurate.

Current State of Risk Management

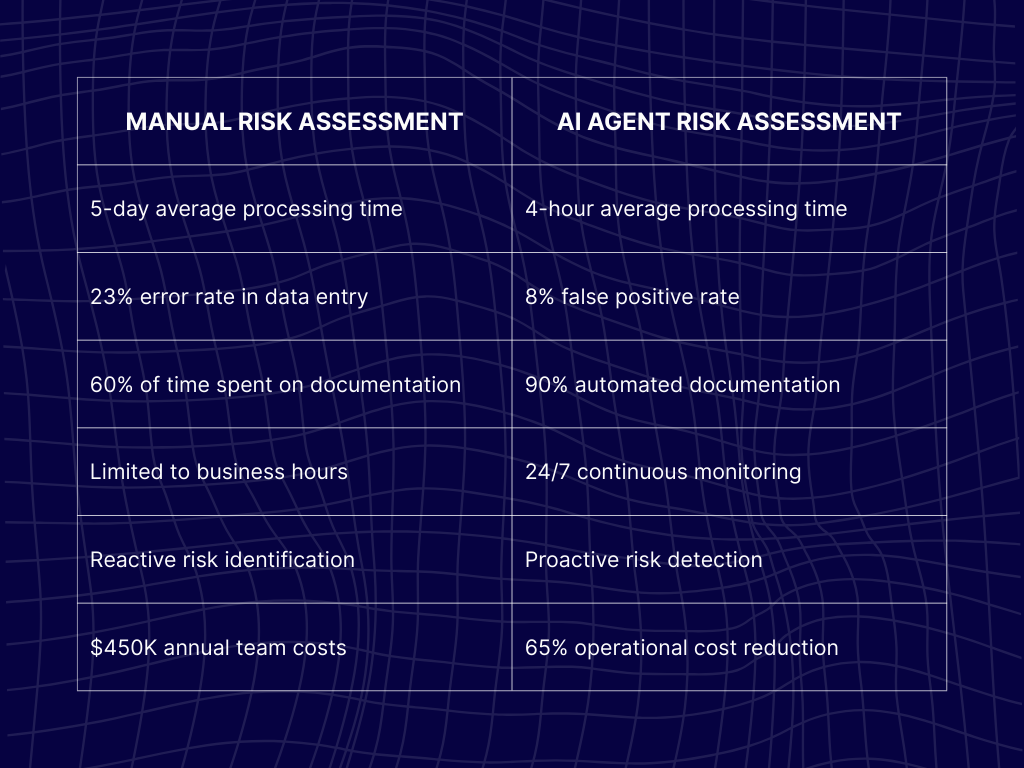

Financial institutions face an escalating crisis in risk management efficiency. Manual processes create 3-5 day delays in critical risk decisions, forcing customers to wait and exposing institutions to competitive disadvantage.

Human error rates in data entry average 23% across financial institutions (Boston Consulting Group, 2024), creating cascading problems throughout risk assessment workflows.

Compliance teams spend 60% of their time on documentation versus actual analysis, turning skilled professionals into data clerks. Meanwhile, legacy systems struggle to scale with transaction volume growth of 15% annually (PwC Banking Trends Report, 2024), creating bottlenecks that worsen over time.

The cost of these inefficiencies extends beyond operational expenses. When risk assessment delays impact customer decisions, institutions lose business to faster competitors. When manual errors slip through, regulatory penalties follow.

Credit Risk AI Agents

People in risk departments spend many hours reviewing credit details. Credit risk AI agents handle much of this work in a fraction of the time. They can cut the process by over 80 percent and catch errors humans might miss. This helps banks make quicker, safer decisions.

What Happens When Risk Assessment Slows Down

Delays in checking risks make customers wait and sometimes push them toward faster options. Mistakes during manual checks can lead to penalties or losses. AI agents in finance reduce these delays and mistakes.

Why Traditional Risk Assessment Falls Short

Many risk teams still struggle with tools that don’t talk to each other. This means analysts have to jump between systems just to collect basic information. As a result, they often miss key details and end up making decisions without the full picture.

Old-school, rule-based systems also fall short. They can't pick up on unusual patterns or changes the way a human can. These systems follow fixed rules and fail to keep up with new or unexpected risks.

Repetitive tasks are another big problem. Risk experts spend too much time on data entry instead of using their skills to actually assess threats. This kind of work leads to burnout and mistakes—especially when sharp focus is needed most.

And perhaps the biggest issue? Traditional methods spot risks only after they’ve become a problem. By then, it’s often too late. Modern risk management needs to be proactive, not just reactive.

Moving to Autonomous Agents in Banking for Smarter Risk

The future is about catching risk early. Autonomous agents in banking watch ongoing activities and send alerts before issues grow. This helps banks avoid losses instead of fixing problems after the fact.

How Agentic AI Transforms Risk Assessment Workflows

Agentic AI is changing how financial firms assess risk. Instead of relying only on static models and manual reviews, these AI agents can learn, adapt, and act across workflows. They analyze data in real time, detect anomalies faster, and recommend actions.

What Makes AI Agents Different

AI agents for risk assessment operate autonomously within predefined parameters, making thousands of micro-decisions without human intervention. Unlike traditional automation that follows rigid if-then rules, these agents adapt their approach based on context and continuously learn from new risk patterns and outcomes.

Real-time data integration across multiple sources gives agents comprehensive views that manual processes can't achieve. While human analysts might check three data sources, agents monitor 50+ risk indicators simultaneously, identifying correlations humans would miss.

Proactive risk identification before issues escalate transforms risk management from damage control to prevention. Agents spot early warning signals and flag concerns before they become problems.

Core Components of Agentic Risk Assessment

Here’s how different types of AI agents in finance can make risk assessment faster, smarter, and more reliable:

- Data ingestion agents keep an eye on everything from transactions to news alerts. They gather and clean data from markets, regulations, and third-party feeds and update risk profiles in real time.

- Analysis agents go beyond just numbers. They use machine learning to find strange patterns, assign risk scores, and uncover hidden threats. These agents blend hard data with softer insights to give a well-rounded view of risk.

- Workflow orchestration agents act like smart traffic controllers. They send urgent cases to experienced analysts and let routine ones move along on their own. This helps teams stay focused and meet deadlines.

- Reporting agents take care of compliance work. They auto-generate audit reports and regulatory filings, making sure nothing is missed. This frees up time for deeper, strategic thinking instead of paperwork.

Together, these agents turn risk assessment from a slow, manual process into a smart, efficient system.

Step-by-Step: AI Agents in Finance for Risk Assessment

Here’s a simple step-by-step guide to deploying AI agents for risk assessment in financial services:

Phase 1: Risk Workflow Mapping (Week 1-2)

Begin by identifying current manual touchpoints and decision trees in your existing risk assessment process. Document every step where humans currently gather data, make decisions, or create documentation. This mapping reveals automation opportunities and potential bottlenecks.

Map data sources and integration requirements, cataloging every system that provides risk-relevant information. Include core banking platforms, external credit databases, regulatory feeds, and internal risk management tools.

Define risk thresholds and escalation triggers that align with your institution's risk appetite and regulatory requirements. Establish clear criteria for when agents should escalate cases to human reviewers versus processing them automatically.

Establish compliance checkpoints and audit trails that satisfy regulatory requirements. Document how agents will maintain decision transparency and provide explainable outcomes for auditors.

Phase 2: Agent Configuration (Week 3-4)

Build data monitoring agents using AmpCome's visual interface, connecting to identified data sources without coding. Configure agents to normalize different data formats and establish refresh frequencies appropriate for each source.

Configure risk scoring models and decision logic based on your institution's established methodologies. Import existing risk models or build new ones using the platform's machine learning capabilities.

Set up automated notifications and case routing to make sure the right people receive alerts about high-risk situations. Configure escalation paths and response time requirements for different risk levels.

Integrate with existing risk management systems through APIs, ensuring agents work within current technology infrastructure rather than replacing it.

Phase 3: Testing and Validation (Week 5-6)

Run parallel processing with existing workflows to validate agent performance against known outcomes. Process historical cases through both manual and automated pathways to identify discrepancies.

Validate agent decisions against historical cases where outcomes are known. This backtesting reveals model accuracy and helps fine-tune decision parameters.

Fine-tune risk thresholds based on false positive rates observed during testing. Adjust sensitivity to balance thoroughness with efficiency.

Train staff on new agent-assisted processes, ensuring smooth transition from manual to automated workflows. Focus on exception handling and agent oversight responsibilities.

Phase 4: Full Deployment (Week 7-8)

Migrate live workflows to agent-based processing in phases, starting with lower-risk cases and gradually expanding scope. Monitor performance closely during initial deployment.

Implement monitoring dashboards for performance tracking, giving managers real-time visibility into agent performance and case volumes.

Establish continuous improvement feedback loops where agent performance data drives ongoing optimization. Schedule regular model updates and threshold adjustments.

Document new procedures for compliance audits, ensuring regulatory requirements are met and auditors understand the new process flow.

ROI & Performance Metrics of AI Agents in Finance That Matter

When it comes to AI in risk assessment, ROI isn’t just about cutting costs. It’s about how quickly the system detects threats, how many manual hours it saves, and how accurately it flags real risks. Understanding which performance metrics actually matter can make or break your AI investment.

1. Time Savings Quantified

Initial risk screening sees an 85% reduction from 4 hours to 36 minutes per case (Accenture Process Automation Study, 2023). This dramatic improvement allows institutions to process more applications with existing staff or redeploy resources to higher-value activities.

Compliance documentation time drops 70% from 2 days to 6 hours, eliminating the bottleneck that often delays final risk decisions. Automated generation make sure consistency and completeness while freeing analysts for strategic work.

Exception handling becomes 60% faster as agents pre-analyze cases and provide relevant context to human reviewers. Staff spend less time gathering information and more time applying judgment.

Monthly risk reporting achieves 90% automation rate, transforming a week-long manual process into a same-day automated delivery.

2. Cost Impact Analysis

Personnel costs reduce by $450,000 annually per 10-person risk team through efficiency gains and reduced manual work. This doesn't necessarily mean staff reductions—often teams can handle more volume or take on strategic initiatives.

Regulatory fine risk decreases by 40% through improved accuracy and faster response times. Better documentation and consistent processes reduce regulatory scrutiny and penalty exposure.

Technology ROI reaches 340% within 18 months (Forrester Total Economic Impact of AI Agents, 2024), making AI agents one of the fastest-payback technology investments in financial services.

Operational efficiency gains worth $2.3 million over 3 years compound as agents become more sophisticated and handle increasing portions of the workflow.

3. Accuracy and Compliance Improvements

False positive rates drop from 23% to 8%, reducing unnecessary investigations and improving customer experience. Fewer false alarms mean staff focus on genuine risks.

Regulatory reporting errors reduce by 78% through automated generation and validation. Consistent, complete reports reduce regulatory questions and demonstrate process control.

Risk detection speed improves 5x for critical alerts, enabling faster response to emerging threats. Early warning systems become truly predictive rather than reactive.

Audit preparation time cuts from weeks to days as agents maintain complete decision documentation automatically. Auditors spend less time understanding processes and more time validating controls.

Case Study: Mid-Size Bank Transforms Credit Risk Assessment

Challenge

A regional bank with $8 billion in assets struggled with 5-day credit decision cycles that frustrated customers and lost business to competitors. Manual risk scoring produced 15% error rates, creating regulatory concerns and costly rework. Credit officers spent most of their time gathering data rather than analyzing creditworthiness.

Ampcome Solution Implementation

The bank deployed 3 specialized AI agents for data collection, analysis, and reporting. Data collection agents integrated with the core banking system and external credit databases, automatically gathering comprehensive customer profiles.

Analysis agents applied sophisticated risk models across 12 different loan product types, generating consistent scores and recommendations. Reporting agents created decision documentation and compliance records automatically.

Results After 6 Months

Credit decisions reduced from 5 days to 4 hours average, dramatically improving customer satisfaction and competitive position. Risk scoring accuracy improved from 85% to 96%, reducing both false positives and genuine risks that slipped through.

Loan officer productivity increased 250% as they focused on relationship management and complex cases rather than data gathering. Officers became consultants rather than data clerks.

Compliance documentation became fully automated, eliminating the manual process that previously consumed hours per application. Audit trails became comprehensive and consistent.

The bank achieved $1.2 million in annual operational cost savings through efficiency gains and reduced errors. More importantly, faster decisions and improved accuracy strengthened customer relationships and competitive position.

Implementation Checklist: 30-Day Risk Agent Deployment

Technical Prerequisites

API Access to Core Risk Management Systems

- Document existing APIs and integration points

- Test connectivity and data quality from source systems

- Establish authentication and security protocols

- Validate data refresh frequencies and update mechanisms

Data Quality Assessment and Cleanup Completion

- Audit data accuracy across all source systems

- Standardize data formats and field definitions

- Resolve duplicate records and missing information

- Establish ongoing data quality monitoring

Security Protocols for AI Agent System Access

- Define role-based access controls for agent management

- Implement encryption for data transmission and storage

- Establish audit logging for all agent activities

- Configure network security and firewall rules

Integration Testing Environment Setup

- Create isolated testing environment

- Populate with representative sample data

- Configure agent testing protocols

- Establish performance benchmarking baselines

Organizational Readiness

Risk Team Training on Agent-Assisted Workflows Completed

- Train staff on new processes and exception handling

- Develop competency in agent configuration and monitoring

- Establish roles and responsibilities for human oversight

- Create reference materials and troubleshooting guides

Change Management Communication Plan Executed

- Communicate benefits and address concerns proactively

- Involve key stakeholders in planning and testing

- Establish feedback channels for continuous improvement

- Celebrate early wins to build momentum

Compliance Team Approval on New Procedures

- Review agent decision-making processes with compliance

- Validate audit trail and documentation capabilities

- Confirm regulatory requirement satisfaction

- Establish ongoing compliance monitoring procedures

Success Metrics and KPIs Defined and Baselined

- Establish current performance baselines

- Define success criteria and measurement methods

- Create monitoring dashboards and reporting schedules

- Set expectations for improvement timelines

Go-Live Requirements

Agent Performance Monitoring Dashboards Configured

- Real-time performance metrics and alerts

- Historical trend analysis and reporting

- Exception handling and escalation tracking

- User adoption and satisfaction monitoring

Escalation Procedures for Edge Cases Documented

- Define criteria for human intervention

- Establish escalation paths and response times

- Create decision trees for complex scenarios

- Train staff on escalation protocols

Rollback Procedures Tested and Validated

- Develop comprehensive rollback plans

- Test failover to manual processes

- Validate data integrity during transitions

- Establish rollback decision criteria

Post-Implementation Support Resources Allocated

- Assign dedicated support team members

- Establish help desk procedures and resources

- Create troubleshooting guides and FAQs

- Plan regular check-ins and optimization reviews

Risk Mitigation: Addressing AI Agent Concerns

As banks and finance companies start using AI agents to assess risk, many people worry about mistakes, lack of clarity, or losing control. It’s important to fix these issues early. By setting clear rules and making AI decisions easy to understand, companies can use AI safely and gain its full benefits.

1. Data Security and Privacy

End-to-end encryption protects all agent communications and data processing. Financial institutions can't afford security breaches, and AmpCome's architecture assumes zero trust principles throughout.

Role-based access controls and audit logging make sure appropriate access levels and complete activity tracking. Every agent action gets logged with user attribution and timestamp information.

GDPR and CCPA compliance is built into agent architecture rather than added later. Privacy-by-design principles govern data handling, and consumers maintain rights to explanation and data portability.

Regular security assessments and penetration testing validate ongoing protection. Third-party security firms conduct quarterly assessments to identify and address potential vulnerabilities.

2. Regulatory Compliance Safeguards

Explainable AI features satisfy audit trail requirements by documenting decision logic and data inputs for every automated decision. Regulators can understand exactly how agents reached specific conclusions.

Human oversight controls make sure high-stakes decisions include appropriate human review. Agents flag cases requiring human judgment and provide relevant context for decision-makers.

Automated compliance reporting and documentation eliminate manual compliance tasks while ensuring completeness and accuracy. Reports generate automatically with proper formatting and required disclosures.

Regular model validation and bias testing protocols identify and correct algorithmic issues before they impact operations. Models undergo periodic review to make sure ongoing accuracy and fairness.

3. Operational Risk Management

Fail-safe mechanisms prevent agent malfunctions from impacting operations through circuit breakers and automatic fallback to manual processes when performance degrades.

Continuous monitoring alerts immediately notify administrators of performance degradation or unusual patterns. Real-time dashboards provide visibility into agent health and performance metrics.

Backup manual processes remain available during transition periods, ensuring business continuity if technical issues arise. Staff maintain skills and procedures for manual processing as needed.

Staff training makes sure smooth human-agent collaboration by clearly defining roles, responsibilities, and interaction protocols. People understand when to intervene and how to work effectively with agents.

Frequently Asked Questions

- How quickly can AI agents in finance be deployed for risk assessment?

Most organizations see initial agent deployment within 30-45 days, with full workflow automation achieved in 8-12 weeks depending on system complexity. The timeline depends largely on existing system integration requirements and data quality. Organizations with clean, well-integrated data can deploy faster, while those needing significant data preparation require more time.

- What's the learning curve for risk teams using AI agents in Finance?

AmpCome's no-code platform requires minimal technical training. Most risk professionals become proficient in agent management within 2-3 weeks. The visual interface eliminates coding requirements, and built-in templates accelerate initial configuration. Ongoing training focuses on interpreting agent recommendations and handling exceptions rather than technical administration.

- Can AI agents handle regulatory compliance requirements?

Yes, agents can be configured to automatically generate compliance documentation, maintain audit trails, and make sure adherence to regulations like SOX, GDPR, and Basel III. Regulatory compliance features include explainable decision-making, complete audit trails, and automated reporting that satisfies regulatory requirements. Agents maintain documentation standards that often exceed manual processes.

- What happens if an AI agent makes an incorrect risk assessment?

Agents include confidence scoring and human escalation triggers. Critical decisions always include human oversight, and machine learning models continuously improve from corrections. When errors occur, agents learn from feedback and adjust future decisions accordingly. The combination of confidence thresholds and human oversight make sures mistakes don't compound.

- How do AI agents integrate with existing risk management systems?

Ampcome agents connect via APIs to popular platforms like GRC tools, core banking systems, and data warehouses without requiring system replacements. Standard integrations exist for major platforms, and custom connections can be built for proprietary systems. Deployment best practices make sure seamless integration with minimal disruption to existing workflows.

Transform Your Risk Assessment Workflows Today

Financial institutions can no longer rely on slow, manual methods to assess risk. Mistakes are costly, and rules from regulators are getting stricter every year. AI agents help solve this problem. They work faster, make fewer mistakes, and help companies save money while staying within the rules.

Banks and financial firms using AI agents already report major benefits. They make decisions faster, catch problems earlier, and reduce the need for manual work. With big fines on the rise and customers expecting quick answers, switching to AI is no longer optional.

Ampcome’s no-code platform makes it easy to start. You don’t need a team of developers or months of setup. Just start with one workflow and expand as you see the impact.

The financial world is changing fast. Companies that wait too long risk falling behind. AI agents are already proving their worth, and the results speak for themselves.

Want to see how it works? Book a free demo and explore Ampcome in action.

Transform Your Business With Agentic Automation

Agentic automation is the rising star posied to overtake RPA and bring about a new wave of intelligent automation. Explore the core concepts of agentic automation, how it works, real-life examples and strategies for a successful implementation in this ebook.

More insights

Discover the latest trends, best practices, and expert opinions that can reshape your perspective

Contact us